How to Prevent Payment Fraud for Retail Businesses in 2024

With the rapid growth of online shopping, it’s no wonder that fraudsters have more opportunities than ever to steal funds and sensitive data from unsuspecting merchants and customers.

MasterCard’s report predicts that online payment fraud will cause global losses of approximately $48 billion by the end of 2023 — a staggering 16% increase from the previous year. You see, this alarming statistic underscores the urgency for businesses to combat payment fraud and protect their revenue.

As a retail business owner in 2024, you may wonder how to protect your business from these bad guys. Fear not, and we’ve compiled a list of 7 effective strategies to reduce the payment fraud risk in the retail industry. The answer is right ahead, keep scrolling and we’ll show you how!

What Is Payment Fraud?

Payment fraud means the unauthorized use of someone’s payment information, such as a credit card, to make a purchase. In the case of payment fraud, the real card owner eventually realizes something has happened when they see their statement and find purchases on it that they haven’t made.

Other times, the customers may falsely claim to have not received what they bought and demand a refund. This is also considered online payment fraud.

Example: You’re sitting at home and receiving a notification on your phone about a $500 online shopping order you didn’t make. You didn’t hand your credit card to anyone, but someone used your card details to buy items online without your permission.

How Does Payment Fraud Damage Your Businesses?

The 4 most common ways in which payment fraud can impair businesses include:

- Reputational Loss: Fraud can result in a loss of reputation. Besides, faulty disputes are a massive problem for the stores, as they have to focus on these disputes, which might result in losses of time and money. Moreover, when the banks or any other merchant account providers feel like doing business with a particular company is risky, they could shut your account down to curb these issues.

- Financial Impact: A significant business impact of payment fraud is the economic impact. For example, Juniper Research has projected that the financial impact of payment fraud will amount to $362 billion over the period from 2023 to 2028.

- Operational Disruption: At times, infringement could also be referred to as an act by the company. They will be forced to thoroughly investigate the fraudulent transactions and implement changes in their security measures. Additionally, they may sometimes develop new policies and procedures in place.

- Chargeback Fees: A fee charged to the business for a customer’s dispute over a charge on their credit card bill.

Types of Payment Fraud

There are at least ten types of payment fraud that businesses need to be aware of:

1. Online Phishing

Phishing is a fraudulent practice where, through the use of email or any other communication modes, the attacker cloaks himself as a reputable person or organization. Attackers often use combinations of social engineering methods that could disseminate links or attach malicious files that can recover the user’s login credentials, account numbers, and other personal details.

2. Skimming

Skimming fraud is a white-collar crime involving taking a business’s cash before recording it into the accounting system.

Example: Lucy runs a coffee stand and has just hired a new staff. Two weeks after this hiring, she saw that the revenues had fallen by 30%. She planted a hidden camera and found that the new staff did not issue receipts to customers who paid in cash.

In addition, customers generally did not ask for receipts as the amounts involved were very small. On the other hand, Lucy could not establish the fraud from the accounting books because the transactions were never captured.

3. Identity Theft

Identity theft is when someone takes your personal details and uses them without your permission, often to commit fraud. This one can take several forms, but the most common is financial.

4. Card-not-present Fraud (CNP)

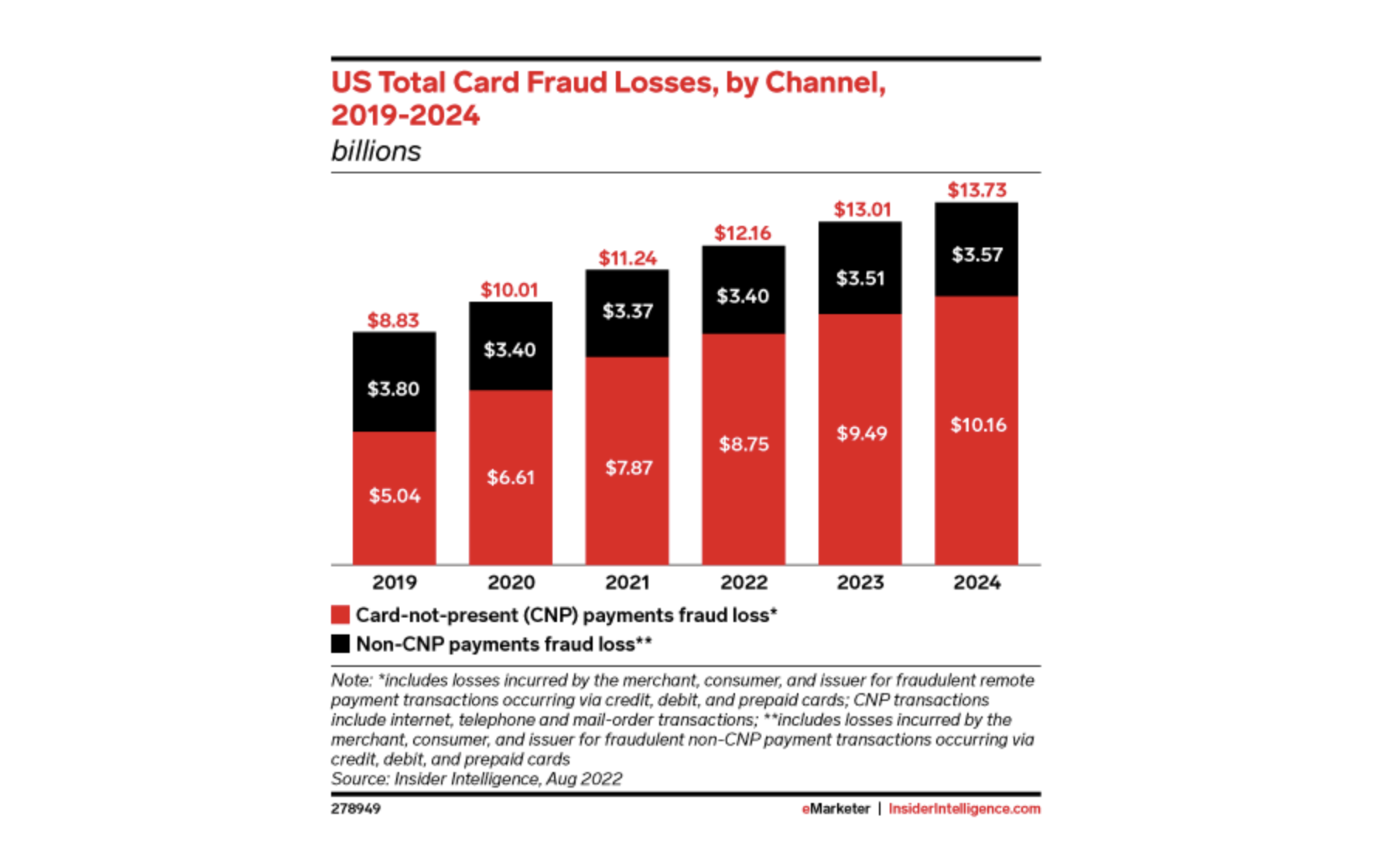

CNP fraud happens when someone purchases online, over the phone, or through mail order using stolen credit card details. This kind of fraud doesn’t require the physical card to be seen by the seller (contactless payment fraud), which is why it’s tricky.

By 2024, Insider Intelligence expects that 74% of all fraud will be CNP fraud. This marks a significant jump of 57% from the levels we saw before the pandemic back in 2019.

Basically, if someone gets hold of your credit card number, your name, and that little three-digit code on the back of your card (either by stealing it or buying these details from shady places online), they can use this info to shop online or make orders over the phone as if they were you.

5. Chargebacks (Friendly Fraud)

Friendly fraud might sound sociable, but in reality, it’s pretty unsavory. It occurs when a customer buys a good or a service online using their credit card and then files a chargeback with their credit card company, claiming they never made the purchase. The fraud is termed “friendly” because the customer’s dispute typically looks legit.

Some typical examples customers will say when contacting their credit card issuer with a payment fraud claim:

- The customer reports that the item wasn’t delivered.

- The usual: the customer claims that the item purchased doesn’t match the online description and is trying to return it.

- The customer says they canceled the order, but it was sent anyway.

- The customer tells their credit card issuer they returned the item, but the merchant has not received or refunded it.

- The customer says they don’t remember purchasing, so their credit card must have been compromised.

6. Authorized Push Payment Fraud (APP) (aka Wire Transfer Scams)

In APP fraud, a fraudster tricks a payer into making a payment under false pretenses. Most APP scams involve the fraudster pretending to be from a trusted entity — like the payer’s bank or a known company’s billing department — to make the transaction seem real.

This one sounds like online phishing, but in nature, they are not the same. APP fraud tricks people or businesses into sending money to a scammer’s account. Meanwhile, online phishing aims to get personal details like IDs, bank and card info, and passwords.

7. Clean Fraud

Clean fraud is any form of global payment fraud where a fraudster uses stolen credit card data to transact and later manipulates the transaction against payment fraud detection devices. The name describes the underlying property of the transaction, that it will look “clean” and not be caught by fraud filters or blacklists.

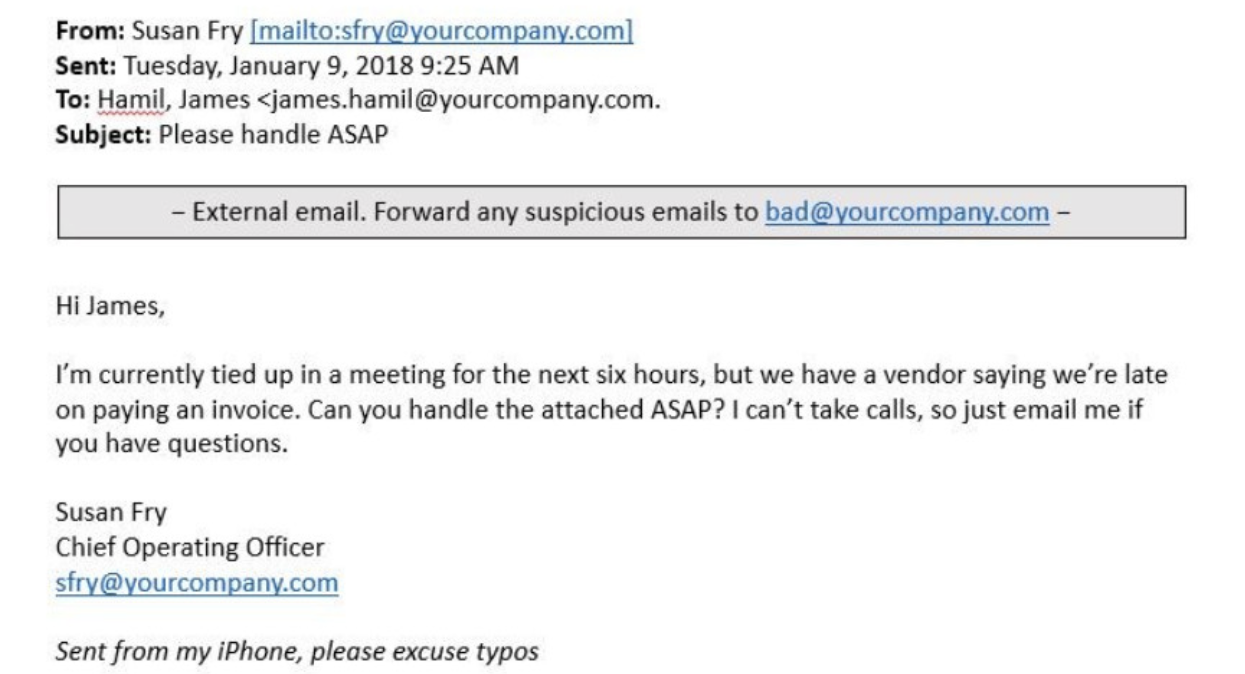

8. Business Email Compromise

Business Email Compromise (BEC) is another type of cybercrime where a scammer uses email to con someone into sending money or sharing confidential company information.

Typically, the criminal pretends to be a trusted party. They may ask a company to pay a fake bill or request data such as employee W-2s, which can be used in other scams. BEC scams have increased as more people work from home — last year, there were more than 21,832 BEC complaints to the FBI.

In the picture below, this contactless payment fraud typically involves an employee or executive’s email account authorized to process invoice payments and fund transfers.

9. Retail Arbitrage Fraud

Retail arbitrage fraud is when a single buyer uses harmful bots to grab many discounted items to sell them again in a different marketplace. Thus, the people can quickly reduce your income and profits to zero, stock wholly emptied, and worse still, your customers who love discounts can disappear. This further gives rise to huge price differentials across marketplaces and leaves room for a lousy shopping experience that pulls down brand value.

10. Merchant Identity Fraud

Merchant fraud happens when a fraudulent entity poses as a merchant to process transactions and eventually steal the finances. This could involve setting up a merchant account to process payments using stolen cards or convincing real customers to make purchases they will never receive.

7 Ways to Prevent Payment Fraud for Retail Businesses in 2024

Payment fraud prevention is integral to modern-day business risk management. The best ways to protect your business are by being educated about the threats commonly faced and training your employees to recognize attempts at perpetrating fraud. This is the same as having a business continuity plan in place in the event of a disaster.

After all, too much is at stake. Many businesses are unsuccessful in recovering any stolen money. Not to mention, a company’s reputation is also smeared.

Here are seven ways to protect the business from payment fraud risk.

1. Train and Rotate Your Staff

First, merchants should hold regular training for staff members on spotting the signs of payment fraud. Your employee training program should focus on detecting fraud and best practices to proactively prevent it.

Train them that when they get a request at work that seems odd or makes you suspicious, here’s what they should do:

Step 1: Pause – Take your time with the request.

Step 2: Verify – Reach out to the person who supposedly sent you the request. Use the phone number or email you know is correct, not any contact details provided in the suspicious request.

Step 3: Confirm – Ask them directly if they sent the request and review what they requested before proceeding.

And after so many years, whether it’s three, five, or seven — it’s time to consider moving employees to new roles. This will help prevent employees from colluding with their coworkers or from becoming the sole owner of specific financial accounts or system information.

2. Limit System Access

The fewer people accessing your credit data, the fewer hackers can exploit your card data environment. In addition, monitoring who is accessing this sensitive customer info also enables companies to detect and respond to suspicious activity in real-time, thereby minimizing the risk of having to issue payment fraud.

Tactics include the following:

- Role-based access controls (RBAC) are a common way to limit access to credit data. For example, financial specialists in an accounting department may have access to credit data, while marketing team members may not.

- Employing the principle of least privilege limits employee access to only the data they need to do their job. So, if an employee’s password is stolen, the amount of exposed data will be minimized.

- Logging and monitoring employee access to credit card data can also help identify and investigate suspicious activity.

3. Use Technology and Software to Detect and Prevent Payment Fraud

While eCommerce stores can’t eliminate the danger of fraud 100%, continuously updating your network security systems will reduce vulnerabilities. This includes using firewalls and antivirus programs as your first line of defense against cyber criminals who want to hack into your network.

To further keep your business safe from fake payments, retailers can consider:

- Keep a watchful eye on fraud trends

- Use a verified payment processor

- Load your data into encrypted emails or transactions

- Use strong passwords and avoid using the same login details on different sites

- Update logins and tokens with new releases when the old ones expire

- Back up your data consistently to ensure you have the latest updates and information

- Develop a process for how you’ll access this sensitive information

- Review your security settings as part of a periodic review with up-to-date antivirus software

- Require customers to log into an individual account before they can buy something

Besides, abiding by the Payment Card Industry Data Security Standard (PCI DSS) is a must if your business takes in online payments. Failure to follow the security protocols can hit you with significant fines and penalties.

4. Add Multi-factor or Biometric Authentication

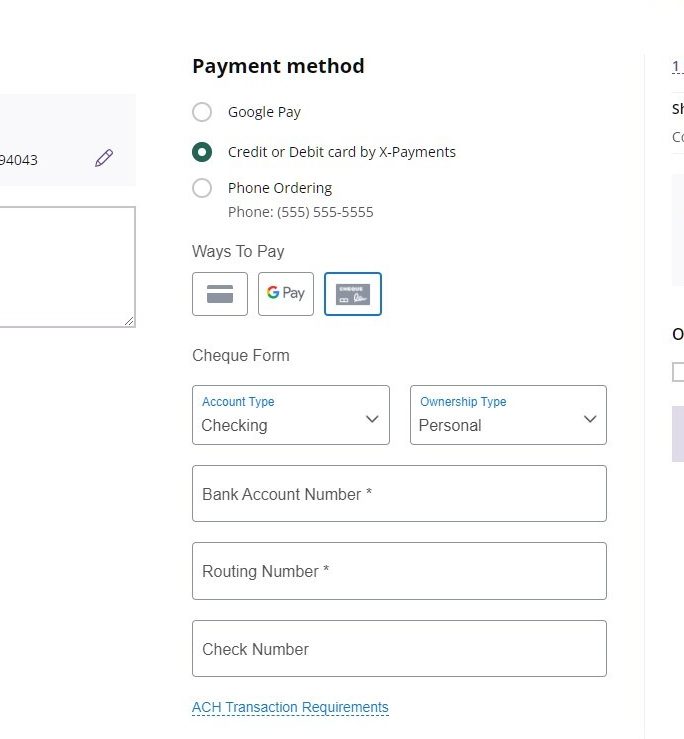

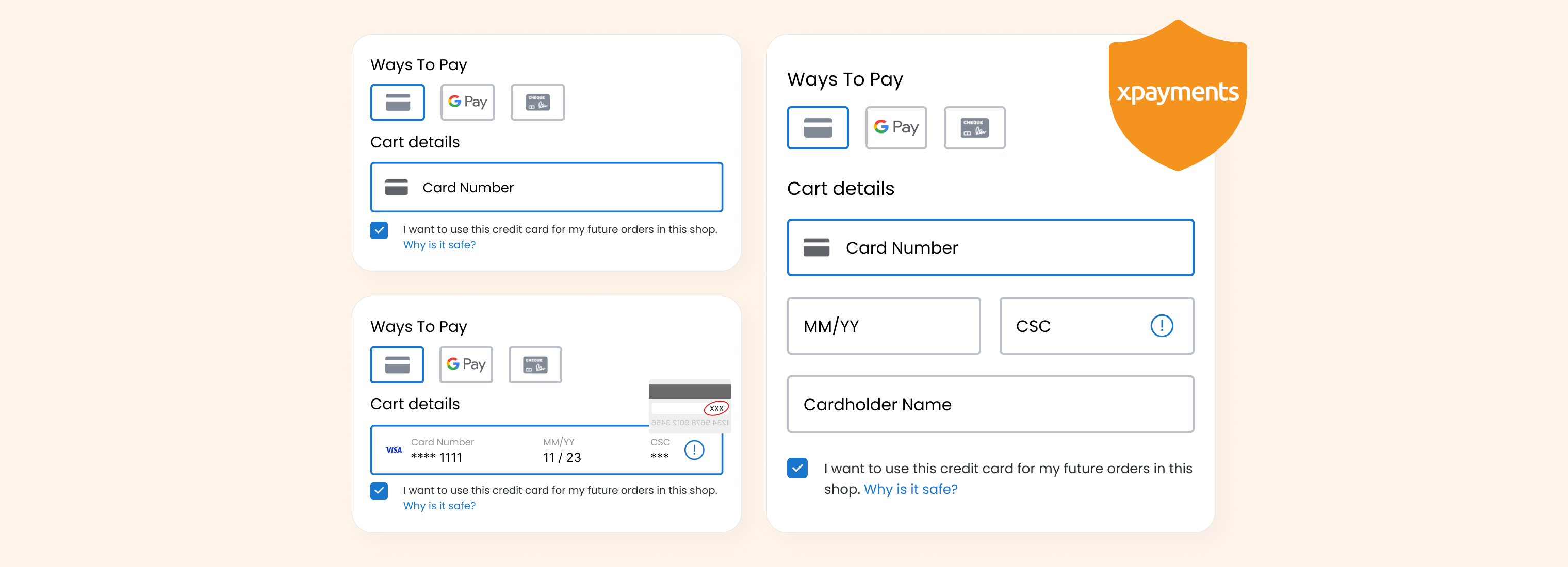

Businesses can use two, multi-factor, or biometric checks to ensure that only approved people get sensitive info. Payment security best practices keep changing with new tech trends. Therefore, choosing a famous payment orchestra platform like X-Payments is vital to constantly improving and keeping up with the latest safety rules.

This way, businesses can get top-notch security for logins and payments without spending their time and money to create, keep up, or update these systems.

5. Ensure Your POS Supports EMV and NFC

For physical stores, at least, this allows two different technologies to collaborate to stop counterfeit transactions.

- With EMV chips, payment processors can recognize secret info on the chip in a card, which lets them spot fake cards and reject them.

- NFC enables you to pay without tapping a card or a phone — the system allows you to pay without an interface that keeps your card info and uses your card’s unique code, so it’s safer and lets systems support payment security rules sooner.

For this, we turned to Magestore POS, a PCI-compliant POS that lets customers pay in various payment options, from credit cards to gift cards to points, and empowers stores with the flexibility to work with any popular payment processor. For example, using a reliable POS for Stripe payment will ensure safe transactions, and completely avoid payment fraud.

6. Watch Out for Emails with Suspicious Content

As previously explained, email attacks are prevalent, primarily involving two types of fraudulent emails: BEC and phishing.

Criminals craft real emails, claiming to be from well-known entities like your bank, a delivery service, your mobile provider, or a famous retailer. After that, when someone clicks a link in such an email and enters sensitive info, the criminal can capture and misuse this data.

Next time, if you’re doubtful about an email or text, it’s safer NOT to click any links. Instead, you should type the website address manually into your Incognito browser or contact the company’s customer support for help.

7. Monitor Your Transactions and Accounts Regularly

Last but not least, retailers should keep an eye on their accounts to spot any odd activities, like weird transactions or changes in how payments are made. Even with robust systems to catch fraud, it’s super valuable to have a person regularly check the payment details to find anything unusual.

Bottom line

Retail businesses in 2024 will need to be proactive as they seek to counter the rising threat of online payment fraud. By understanding the various types of fraud, from phishing to CNP fraud, and implementing preventative strategies such as those we’ve outlined, retail businesses can go a long way toward protecting their bottom lines and reputations.

With so many issues in life, an ounce of prevention is worth a pound of cure — especially when trying to combat global payment frauds.

X-Payments is a Payments Orchestration Platform delivered through a single API for online store businesses. Our company provides ready-made integrations with 40+ card payment gateways, fraud screening apps, and other essential components so you can focus on growing your business — not worrying about payment data compliance, etc.

You can sleep well knowing your business is secure as X-Payments is PSD2/SCA ready and PCI DSS Level 1 Certified.Questions? Simply click here and ask for a FREE trial to see for yourself. Thank you for reading!

Get the Best Expert-Backed Tips into Your Inbox

Only one email a week, we promise

Katie is a retail expert at magestore.com - No.1 POS solution for Magento & Shopify. She provides helpful insights to retailers to operate a store operation seamlessly. Katie has over 4 years of experience working with various retailers, producing high-quality content to educate customers on basic definitions of the industry and giving advice about best practices and solutions for each type of business.